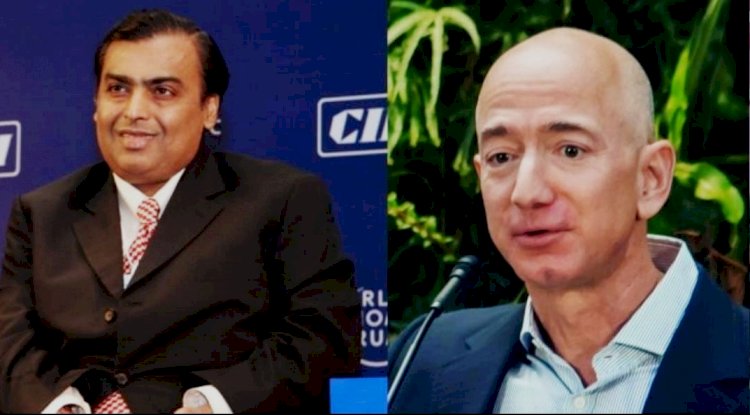

Battle For Retail Dominance Between Two Wealthiest Person - Jeff Bezos And Mukesh Ambani

As Amazon and Reliance win the futures deal, it looks like a big battle is being waged as the world's two richest people have become a major part of India's lucrative retail market.

By blogwriternisha

Recent legal debates over future deals set the stage for a major battle for two of the world's wealthiest men to gain control of retail in India.

Earlier this year, Reliance Industries Limited (RIL), owned by Mukesh Ambani, announced that it had signed an agreement with Kishore Bayani Future Group to acquire assets worth Rs 24,713 in retail. .. Immediately after the deal was announced, Jeff Bezos-owned Amazon intervened.

Amazon has accused Future Group of violating its contractual obligations by deciding to sell its retail assets to Reliance Retail. Future-A a few weeks after the announcement of the Reliance Agreement, Amazon announced a tentative decision by a Singaporean intermediary and temporarily suspended the agreement. The final decision in this case is awaited.

The e-commerce giant also approached Indian market regulator CBE on the deal and accused the Future Group of misleading shareholders about the deal.

However, the legal debate over futures trading seems to be part of a larger battle between Amazon and the Reliance, as 2 billion owners want a larger share of the Indian retail market.

But the legal dispute over the futures market seems to be just part of a big battle between Amazon and Reliance and their two-billionaire owners trying to gain more share of the Indian retail market.

Controversy over the future agreement

Both Mukesh Ambani and Jeff Bezos are aware of the growing retail market in India and the potential of billions of consumers in the country. Many research reports predict that the value of India’s retail market will exceed 1 1 trillion by 2025, making it one of the most profitable in the world.

Recent statements from Amazon suggest that a futures contract is expected to give Reliance an advantage, which has been expanding its retail business since JioMart launched earlier this year.

Amazon has spent billions to start an e-commerce business in India and is determined to expand its operations in the country. However, there is also the fact that Mukesh Ambani does not need to have great confidence in the retail sector if he is to continue to pursue profitable consumer - supporting brands.

Future Group has many well-known brands such as Big Bazaar, Central, FBB, and others. Reliance also has many retail brands, such as Reliance Fresh, Geo Mart, Reliance Digital, AJIO, and Trends Footwear. Reliance is also backed by leading investors such as General Atlantic, Silver Lake, KKR, and others.

In contrast, Amazon has a strong online presence in the country and does not have a physical retail presence due to the country’s restrictions on multi-brand FDI retail, which puts it at a disadvantage.

Offline internet integration

Experts say the evolution of India’s local retail will see a more comprehensive online connection, which Reliance is currently working aggressively on. This gives Reliance an advantage, as the physical presence of the retail will provide more ammunition to dismantle Indian towns and villages.

While online retail is growing in India, experts believe that the physical presence of retail is important in a market like India, where the penetration of the Internet has not yet reached urban and rural areas.

For both Reliance and Amazon, the future deal is a source of controversy - At the moment, Reliance seems to be at the forefront of physical retail, with Amazon and Flipkart leading the internet. However, if Reliance continues to acquire local retail brands, it may not take long to change the situation, which will help the company expand its online offerings through Jiomart.

It remains to be seen whether Amazon digs deep into its pockets to compete with Reliance or decides to sign a deal with a Mukesh Ambani-led company to consolidate its operations in the country.

What's Your Reaction?